It is often said Appraisal (the appraisal clause) is The Wild, Wild, West. With Hawaii, you can’t get much further West in the U.S. (Technically, Alaska is the northernmost, westernmost, and easternmost state in the U.S., for your fun fact of the day.)

Hawaii is fraught with a lack of direction surrounding Appraisal. In the last thirty years, only three court cases have attempted to clarify the process in the state. Two cases stem from Hurricane Iniki in 1992. The other is from 2023 and made it all the way to the Hawaii Supreme Court.

Appraisals from the Lahaina fires have started, and I have already been engaged on two. I have a strong suspicion the upcoming two years will produce multiple cases being litigated regarding Appraisal. The Hawaiian court system will be tested to give the industry a better guide for how to use the process appropriately.

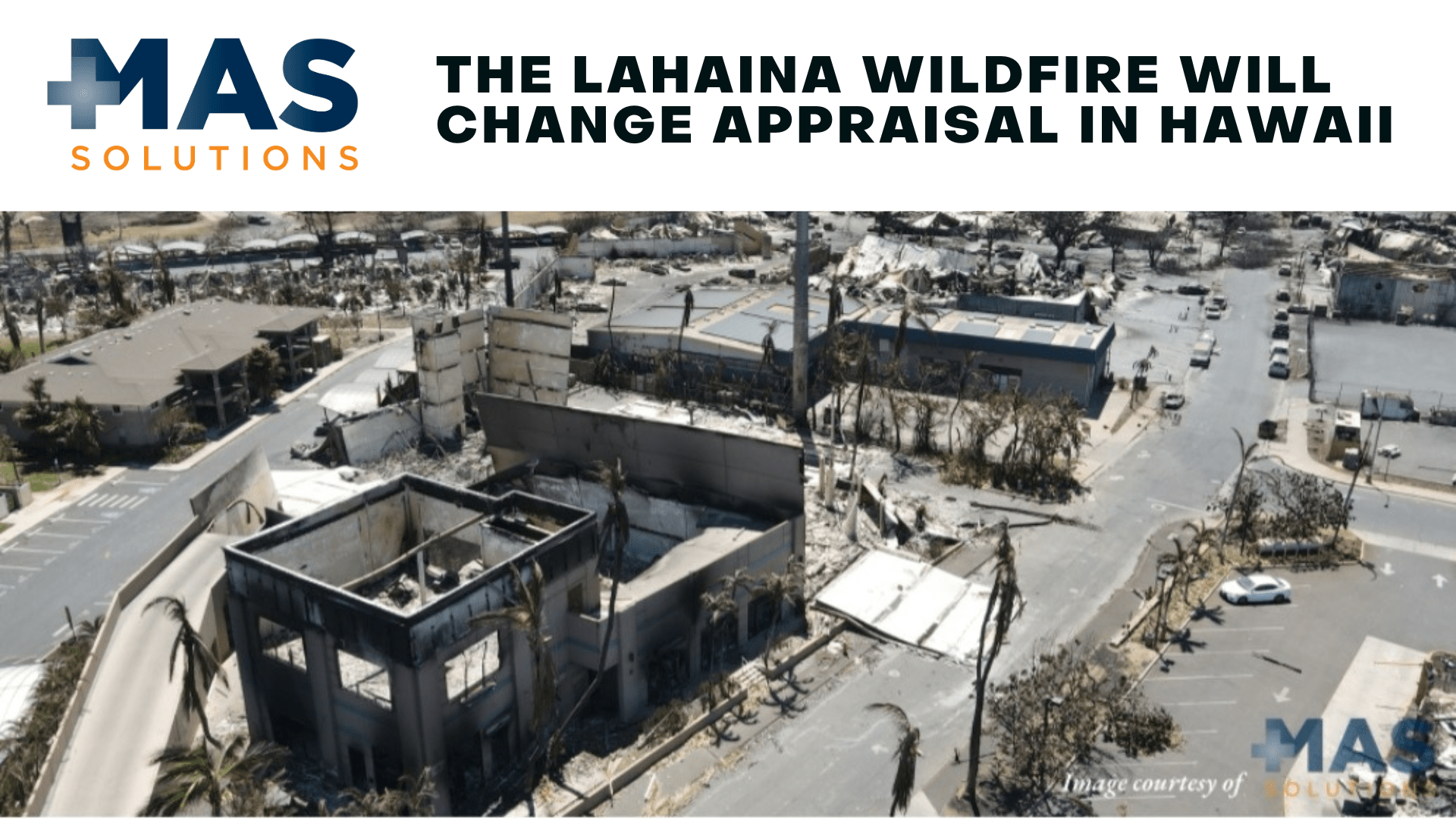

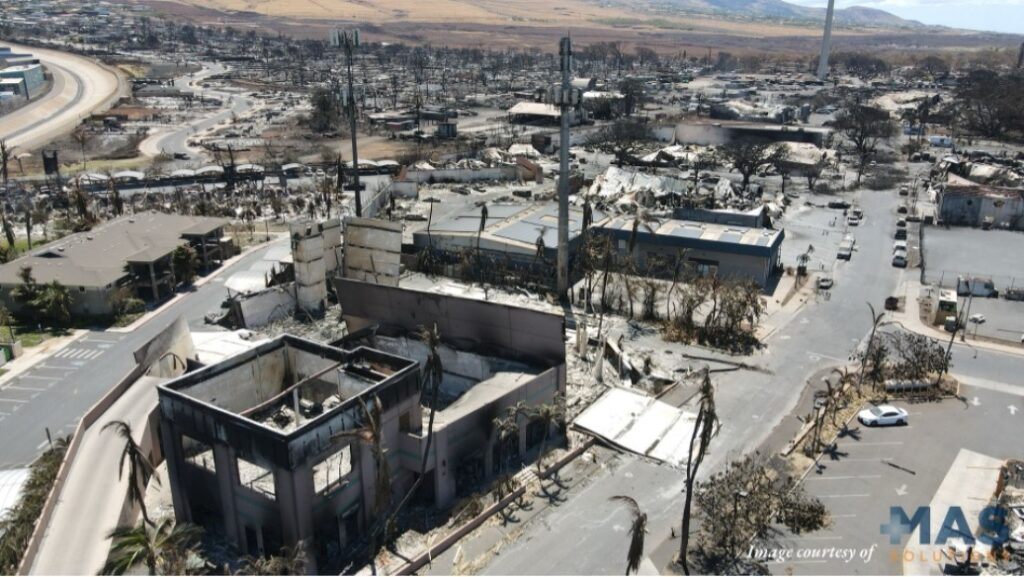

Lahaina Wild Fire Drone image provided by MAS Solutions

Here are some other things regarding Appraisal in Hawaii which have not yet been defined via statute or case law.

- Hawaii has no guide on whether scope can be appraised.

- There is no law on if causation can be appraised.

- The state has no matching statute. (More often than not, matching issues go to umpire.)

- A statute for reasonably similar appearance (or line of sight) does not exist.

- Most counties have a building code stating if you put back what was already there you do not have to do any code upgrade, often causing confusion about whether to appraise code upgrade (law and ordinance) or not.

- There is nothing preventing another person from the same public adjusting firm, or the contractor acting as appraiser (if the policy language doesn’t prohibit it). The same applies if an insurance carrier were to appoint an appraiser from the same company who originally adjusted the loss.

- There is a question of whether an umpire (who was not utilized to resolve the Appraisal) has the authority to reopen the Appraisal without both appraisers agreeing there was a mutual mistake.

Below is the list the historical cases with links to each. While I would love to wax on about each of the cases, there is a lot of depth to each, and unfortunately, I only play an attorney on TV.

Case 1

Christiansen v. FICOH, 1994 (click the link to read the full case text)

Christiansen v FICOH, 1998 (click the link to read the full case text)

This case was originally tried in 1994 and then again in 1998. in the ICA.

Case 2

Wailua Associates v. Aetna, 1995 (click the link to read the full case text)

This case involves the famous Kauai property known as The Coco Palms Resort.

Since these two cases post Iniki, Appraisal has been considered “quasi-arbitration” in Hawaii. Typically the entire panel, the appraisers first, and the umpire after being chosen or appointed, will follow HRS 658-12A which calls for a ten-year disclosure for relationships to any party in the Appraisal. After that Appraisal moves forward as normal. You can read the statute on disclosures here: https://law.justia.com/codes/hawaii/2020/title-36/chapter-658a/section-658a-12/.

Both these cases say Appraisal can be arbitration but it is up to the panel to determine this.

Case 3

Krafchow v. Dongbu, 2023 (click the link to read the full case text)

This case was heard on the circuit level and then to the ICA. It was then appealed to the Hawaii Supreme Court wherein they confirmed the ICA ruling. At issue was whether the plaintiff appraiser and umpire erred in the final award making coverage decisions and stipulating a time for payment of the award. The award was overturned.

CONCLUSION

If you have stuck around to this point…THANK YOU! The Appraisal process is one I find to be valuable as a means in resolving losses without litigation, and something I am passionate about. With the large number of losses coming from the Lahaina Fires, there will certainly be challenges to the process. My hope is the Hawaii courts will give everyone a better roadmap for how appraisals should be handled in Hawaii. Please reach out at any time to discuss Appraisal in Hawaii.